The cryptocurrency market experienced a serious crash in October 2025 leaving many investors shocked. After months of steady growth, the entire market crashed and the two of the largest cryptocurrencies, Bitcoin and other major cryptos tumbled and lost millions in value.

For newbie investors, this crash has led to the common question, “What happened?” The crash has many reasons behind it, which is part of the complexity of the crypto economy. Differing tensions in the economy, regulatory updates, and the emotional reactions of investors have occurred concurrently and created the crash.

For example, the uncertainty of new tariffs and the level of panic was posted in social media around the idea that the new trade tariffs between the U.S. and China had put in place new tariffs fueled the fires of panic and asset sell-offs. This article will break down what happened and why did the crypto market crash in a simple manner that will allow new investors to learn the risks involved as well as the opportunities.

What the Role of Tramp in Crypto market Crash

In October of 2025, the actions of former President Donald Trump would lead to a major drop in the cryptocurrency market. Trump’s 100% tariff on Chinese tech exports and new export restrictions caused global markets to panic and fear. This heightened trade tensions between the U.S. and China, causing upheaval in the minds of market participants, and as a result, many people selling off their crypto assets.

This fear was based on the uncertainty of the looming trade war and its potential impact on the overall economy. The crash caused Bitcoin and other cryptocurrencies to plummet in value in a very short period of time. The incident demonstrated the interconnectedness of political and economic decisions and markets, including the already volatile cryptocurrency market.

Key Events Leading to the October 2025 Crypto Market Crash

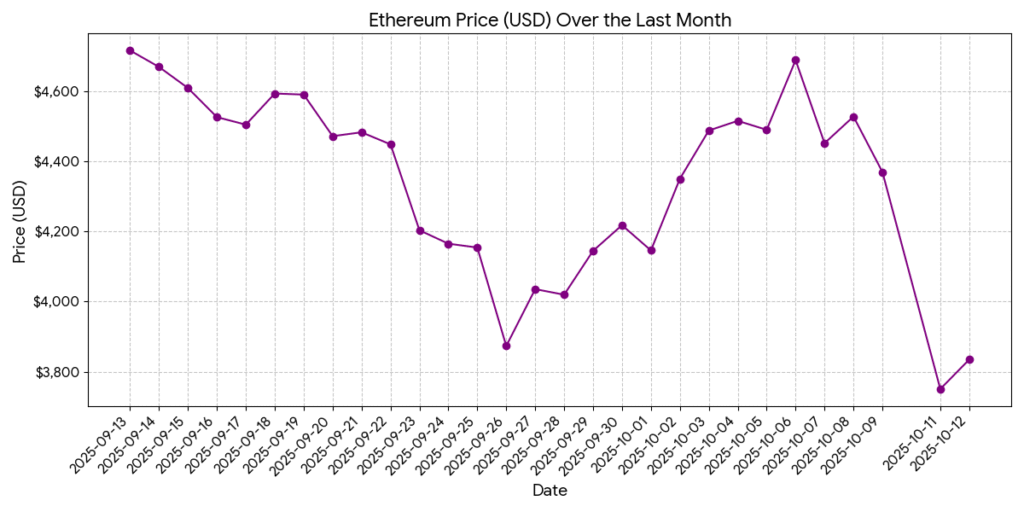

October 2025 saw a dramatic crash in the cryptocurrency market, with major assets like Bitcoin and Ethereum experiencing significant drops in value. Several key events contributed to this sudden downturn. Below, we break down the major factors that led to the crash.

U.S.-China Trade Tensions Escalate

One of the primary catalysts for the October crash was the sudden escalation in U.S.-China trade tensions. Former President Donald Trump announced a 100% tariff on Chinese tech exports and new restrictions on vital software exports. This move raised fears of a prolonged trade war, shaking investor confidence across global markets, including crypto.

Regulatory Concerns and Uncertainty

Regulatory uncertainty surrounding cryptocurrencies also played a role in the crash. With governments worldwide tightening their approach to digital currencies, investors became worried about stricter regulations and potential crackdowns, especially in large markets like the U.S. and the EU.

High Levels of Leverage in the Market

Many crypto investors were heavily leveraged, meaning they borrowed funds to increase their market exposure. When the market started to fall, a series of forced liquidations followed, amplifying the crash. This created a domino effect, pushing the prices of major cryptocurrencies even lower.

Market Sentiment and Fear of a Larger Economic Crisis

As global stock markets showed signs of instability, fear began to spread throughout the financial world. Investors sought safer assets, moving away from riskier assets like cryptocurrencies. This shift in market sentiment played a significant role in the downturn.

Massive Sell-Off Triggered by Panic

As Bitcoin and other digital assets began to decline, panic set in. Investors, fearing further losses, rushed to sell off their holdings. This mass sell-off further drove down the prices, exacerbating the crash.

Regulatory Changes and Their Impact on the Crypto Market

Regulatory changes have a significant impact on the cryptocurrency market, often causing sharp price fluctuations. Governments worldwide are still grappling with how to regulate digital currencies, and any announcements of stricter regulations tend to create uncertainty.

For example, new tax rules, stricter anti-money laundering policies, or outright bans on crypto trading in certain countries can lead to panic selling and market drops. Conversely, positive regulatory news, such as clearer guidelines or approval of crypto-based financial products, can boost investor confidence and drive prices up.

In October 2025, concerns over potential global crypto regulations contributed to market volatility. Ultimately, the crypto market’s sensitivity to regulation highlights the need for investors to stay informed about legal changes that could affect the value and accessibility of digital assets.

The Influence of Global Economic Conditions in October 2025

In October 2025, global macroeconomic factors came to a head that resulted in a very large crash in the cryptocurrency market values. A global financial environment encompassed with rising inflation levels and the potential for a global recession fueled the volatility.

Economic instability of significant economies such as the U.S. and China rapidly shifted investor sentiment toward risk aversion as large asset holders began to sell off their “risky” assets, which included cryptocurrencies. When the U.S. government placed tariffs on tech exports from China, tensions between the two largest global economies reached a fever pitch.

This caused exacerbation of concerns that the two largest economies could be entering a long trade war with huge ramifications for global trade levels, global growth, and investor appetite for risk.

Simultaneously, fears of inflation took hold in the minds of investors due to other global economies announcing interest rate rises which caused a high level of uncertainty for investors and an angry headwind against buying/holding higher risk assets like cryptocurrencies, what might happen if monetary policy was continued to be “tightened”.

Investors seeking to de-risk portfolios looked to offload high risk assets like cryptocurrency to safer traditional assets such as gold or government bonds as a result, a large volume of sell orders cascaded throughout the market and many price declines occurred.

Environmental pressures on cryptocurrencies were building as various other countries were introducing changes to their individual regulatory environments. All of these factors wrapped into one massive chain reaction describing geopolitical tension, economic instability, and regulatory uncertainty coined the perfect storm for the massive wave of short sales that occurred in October that crushed cryptocurrency market values. In 2025.

Economic Indicators: Warning Signs Before the Crash

Before the crypto market crash in October 2025, several economic indicators served as warning signs, signaling a potential downturn. These signs were closely linked to broader financial conditions, including inflation, interest rates, and geopolitical tensions. Here’s a breakdown of key warning signs leading up to the crash:

Rising Inflation and Interest Rates (July 2025 – September 2025)

In mid-2025, inflation rates in key global economies, including the U.S. and the EU, reached concerning levels. The U.S. Consumer Price Index (CPI) hit 6.5% in July 2025, well above the Federal Reserve’s target of 2%. To curb inflation, the Federal Reserve raised interest rates aggressively. By September 2025, the Fed had raised rates to 5.75%, marking one of the sharpest increases in over a decade. These rate hikes made borrowing more expensive, reducing liquidity in markets and causing investors to shy away from riskier assets like cryptocurrencies.

Trade Tensions and Tariff Announcements (October 2025)

On October 5, 2025, former President Donald Trump announced a 100% tariff on Chinese tech exports. This action sent shockwaves through the global economy, escalating trade tensions between the U.S. and China. Investors grew increasingly worried about the ripple effects of these tariffs on global markets, particularly cryptocurrencies, which are seen as highly sensitive to geopolitical instability. The announcement triggered widespread panic selling in the crypto market.

Stock Market Volatility (August – September 2025)

From late August to September 2025, stock markets around the world showed signs of volatility. Major indices, including the S&P 500 and the Nikkei 225, experienced significant fluctuations, signaling a broader market uncertainty. Crypto markets often mirror trends in traditional financial markets, so the heightened volatility in global equities set the stage for crypto price instability.

Weakening Investor Sentiment (September 2025)

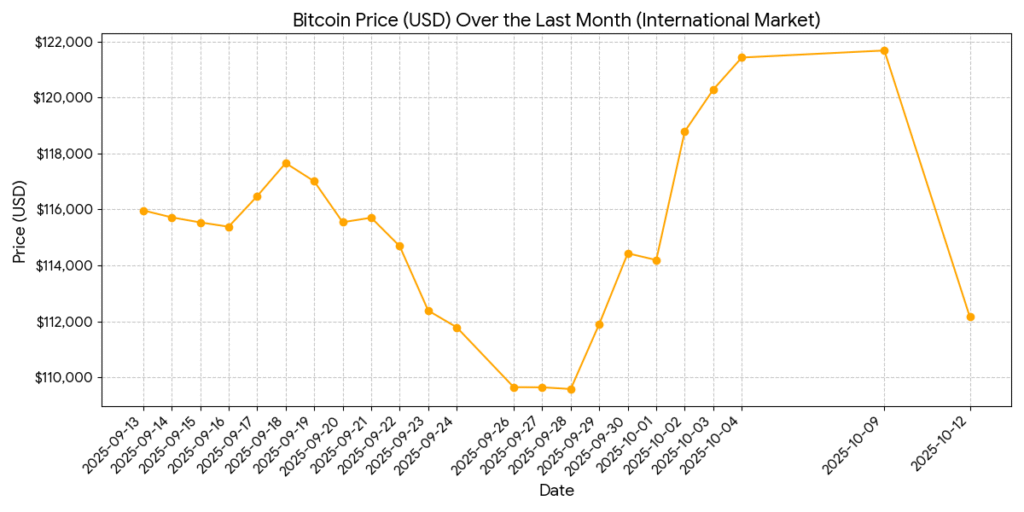

Throughout September 2025, investor sentiment became more cautious, reflected in decreasing volumes of crypto transactions and growing concerns about market overvaluation. Bitcoin’s price had peaked at around $145,000 in late 2024, but by September 2025, it was struggling to hold above $120,000. This downward trend signaled that the market had likely reached its peak, and caution was setting in among investors.

Increasing Regulatory Pressure (September – October 2025)

By September 2025, several countries, including the EU, began introducing stricter regulatory frameworks for cryptocurrencies. This included new tax laws, anti-money laundering requirements, and proposals for stricter trading controls. The growing regulatory pressure created unease in the market, with investors unsure of how these changes would affect their holdings. This uncertainty only contributed to the growing fears of an impending crash.

Investor Sentiment: Panic or Opportunity?

Investor sentiment plays a crucial role in determining the direction of the cryptocurrency market, especially during times of volatility like the October 2025 crash. During this period, the mood among crypto investors shifted dramatically, fueling a wave of panic and uncertainty. However, while many saw the sharp decline as a disaster, others viewed it as a potential opportunity.

Panic Among Investors

As the market dropped, many investors were gripped by fear. The announcement of new trade tariffs, rising inflation, and global economic instability created a sense of impending doom. For many, the significant losses in their portfolios led to a knee-jerk reaction—selling off their assets to cut losses. This mass sell-off amplified the downturn, causing further panic and deepening the crash. Negative sentiment spread quickly through online forums, social media, and news outlets, reinforcing the belief that the crypto market was in serious trouble.

Opportunity for Long-Term Investors

However, not all investors shared the same outlook. Some seasoned crypto traders and institutional investors saw the market drop as a potential buying opportunity. They recognized that crypto, like any other asset, goes through cycles of boom and bust. Historically, major corrections have been followed by recoveries, and many saw the crash as an entry point to buy digital assets at discounted prices.

By maintaining a long-term perspective and focusing on the fundamentals of blockchain technology, these investors viewed the crash not as a threat but as a chance to acquire assets with significant future potential. For them, the market’s volatility presented an opportunity to build stronger positions for future growth, betting on the continued adoption and evolution of cryptocurrencies in the coming years.

Lessons Learned from the October 2025 Crypto Market Crash

- Volatility Is Inevitable: Crypto markets are highly volatile, and sharp price swings are part of the investment landscape. The October 2025 crash reminded investors that significant drops can happen without warning.

- Diversification Is Key: Relying too heavily on one asset can lead to major losses during a market downturn. Diversifying investments across different assets can help reduce risk.

- Avoid Overleveraging: The use of borrowed funds (leverage) can amplify losses during a crash. The importance of managing leverage and staying within one’s risk tolerance became painfully clear.

- Stay Informed About Global Events: Economic and geopolitical developments, such as trade tensions or regulatory changes, can have a massive impact on the crypto market. Staying informed about global events helps investors anticipate potential risks.

- Long-Term Perspective Matters: For seasoned investors, the crash reaffirmed the value of holding a long-term perspective. Short-term drops should be viewed with caution, and focusing on the future growth of crypto can help weather market turbulence.

- Market Sentiment Can Drive Prices: Investor sentiment, often fueled by panic or excitement, can drive prices far from their intrinsic value. Recognizing sentiment-driven movements can help investors avoid emotional decisions.

- Understand the Risks: Crypto is a high-risk asset. The crash highlighted the importance of being aware of these risks before investing, and ensuring that one’s investment strategy aligns with their risk tolerance.

1200 x 628 pixels

Regulatory Developments Matter: Regulatory news can dramatically affect the market. The growing regulatory scrutiny highlighted the need for investors to keep a close eye on regulatory changes to avoid surprises.

FAQs

Crypto is crashing due to regulatory uncertainty, rising inflation, global economic instability, geopolitical tensions, and panic selling. These factors have created fear and uncertainty, leading to widespread market declines.

Predicting crypto’s movement in 2025 is difficult. Market volatility, economic conditions, and regulatory developments will influence its performance. While long-term growth is possible, short-term declines remain a risk.

Trump’s October 2025 announcement of a 100% tariff on Chinese tech exports heightened trade tensions, triggering panic in global markets, including crypto, leading to widespread sell-offs and significant price declines.

Crypto may rise again when economic conditions stabilize, regulations become clearer, and investor sentiment improves. Historically, the market has recovered after crashes, though timing remains uncertain due to ongoing volatility.